🔥☔️ Heatwaves to Downpours: How Seasonal Changes Impact Your Insurance — Are You Covered? By Assuredesk.com – India’s Trusted Insurance Decoder

Whether it's the blistering heat of summer or the drenching rains of monsoon, India’s changing seasons bring more than just discomfort — they bring unexpected risks to your health, vehicle, home, and financial safety. That’s where insurance steps in — but only if it’s the right one.

Let’s decode how seasonal weather affects real-world insurance claims, and how you can stay smartly protected.

☀️ Summer Surge: The Heat Isn’t Just Uncomfortable — It’s Expensive

1. Health Insurance: Heat Makes Hospitals Hotspots

Summer Hospitalization Trends (India)

(Source: IRDAI & Health Ministry)

-

🔺 Heatstroke & Electrolyte Imbalance: +42% spike

-

🤒 Viral Fever & Dehydration: +35%

-

🔴 Skin Infections & Sunburns: +28%

📈 Average hospitalization costs rise by 18% in Tier-1 cities during summer.

🧠 Assuredesk Insight:

If your policy has high co-pay or lacks day-care procedure coverage, you're exposed. Go for cashless health plans with emergency coverage and pre-hospitalization benefits.

📊Heatwave & Health Insurance Impact

🔥 Summer Hospitalization Trends (India)

Source: IRDAI Claims Report & Health Ministry

| Health Condition | % Increase in Summer |

|---|---|

| Heatstroke/Electrolyte Imbalance | +42% |

| Viral Fever & Dehydration | +35% |

| Skin Allergies/Infections | +28% |

🔺 Average hospitalization cost rises by 18% in summers in metro cities.

2. Car Insurance: Heat Can Damage More Than Just Tyres

-

🔋 Battery failures increase by 22%

-

🅿 Tyre bursts jump by 18%

-

🧊 AC compressor repairs spike in metro areas

🧠 Assuredesk Tip:

Don’t rely only on third-party insurance. You need comprehensive coverage with engine protect, zero depreciation, and roadside assistance.

3. Personal Accident Insurance: Summer = More Movement = More Risk

From travel to outdoor jobs, summer increases exposure to:

-

Road mishaps

-

Worksite injuries

-

Heat-induced collapses

💡 Assuredesk Advice:

If your family relies on one earning member, consider a personal accident policy with permanent disability and accidental death benefits.

🏥Accident Claims & Seasonal Shifts

Based on data from Personal Accident Insurers

🧍♂️ Seasonal Risk Index (on a scale of 1 to 10)

| Month | Road Accidents | Workplace Injuries |

|---|---|---|

| April-June | 8 | 7 |

| July-Sept | 9 | 6 |

| Oct-Dec | 5 | 4 |

⚠️ Highest claims in July–August, especially from 2-wheeler accidents in Tier-2/3 cities.

🌧️ Rainy Season Realities: Water Brings Woes

1. Car Insurance Claims Skyrocket During Monsoons

(Source: General Insurance Council)

-

🚗 Waterlogging & engine damage: +44%

-

🛣️ Skidding accidents: +37%

-

⚡ Electrical short circuits: +26%

🧠 Assuredesk Suggestion:

Check if your policy excludes flood damage — many do! Ensure add-ons like hydrostatic cover are included.

🚗Car Insurance Claims: Summer vs Monsoon

Source: General Insurance Council & Industry Claim Portals

| Season | Claim Type | Claim Spike |

|---|---|---|

| Summer | Engine/AC Damage | +22% |

| Summer | Tyre bursts | +18% |

| Monsoon | Waterlogging damage | +44% |

| Monsoon | Collision due to skids | +37% |

| Monsoon | Electrical failures | +26% |

2. Health Insurance: When Rain Pours, Infections Soar

-

🦟 Dengue, malaria, and leptospirosis outbreaks

-

💧 Waterborne diseases rise by 30–40%

-

🩹 Slips & falls lead to emergency OPD visits

🧠 Assuredesk Tip:

Choose plans with nearby cashless hospitals and OPD consultation coverage. Rural and semi-urban hospitals must be on the insurer’s network.

3. Home Insurance: A Neglected Lifesaver

-

🏚️ Leakage & seepage claims rise 2X

-

🔌 Short-circuit fires increase by 35%

-

📉 Floods cause crores in damages every year

🧠 Assuredesk Reminder:

Most Indians ignore home insurance. Even tenants can get contents-only insurance to protect gadgets, jewelry, documents.

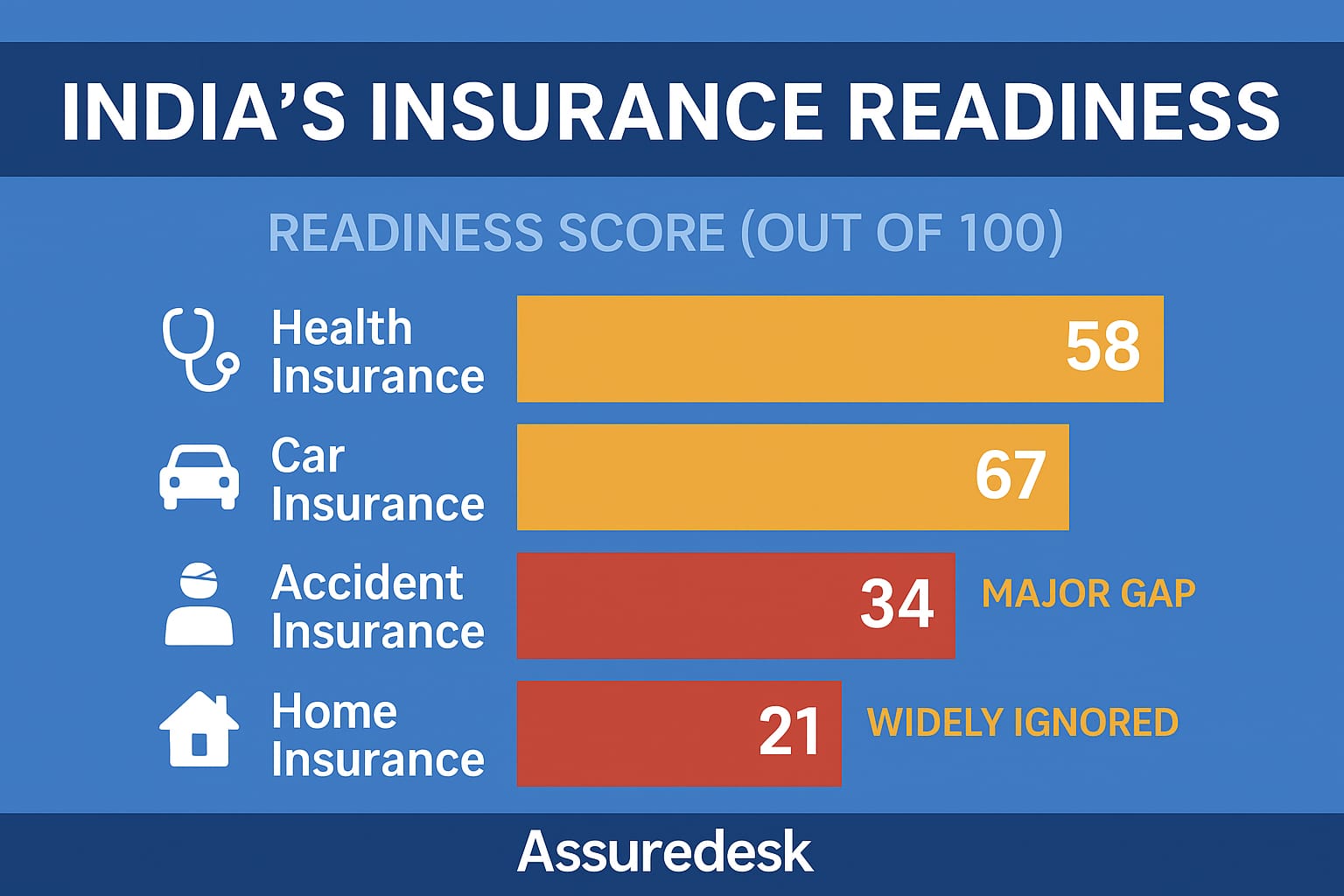

📉 India’s Insurance Readiness: A Data Reality Check

Assuredesk Market Study + Public Insurance Reports

| Insurance Type | Readiness Score (Out of 100) |

|---|---|

| Health Insurance | 58 |

| Car Insurance | 67 |

| Accident Insurance | 34 🔴 (Major Gap) |

| Home Insurance | 21 🔴 (Widely Ignored) |

☂️ Be Weather-Wise, Insure-Smart

Disasters don’t warn you — but smart insurance can protect you.

At Assuredesk, we believe in awareness over aggression, guidance over gimmicks.

💬 Talk to your nearest consultant today. We don't sell insurance — we simplify it.